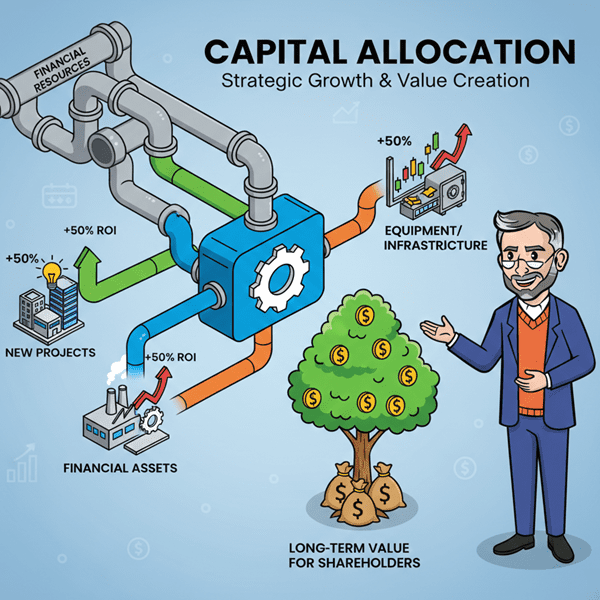

What is Capital Allocation?

Definition: Capital allocation is the process of deciding how to distribute financial resources within a company or investment portfolio. It involves choosing where to invest, whether in new projects, equipment, or financial assets, to get the best returns. Good financial planning helps the business grow and increase value for its owners or shareholders.

Example in a Sentence: The company’s capital allocation strategy focused on expanding its product line and investing in technology to improve efficiency.

Why is Capital Allocation Important?

1. Getting the Best Return on Investment

Proper investment management makes sure the money is spent in areas that generate the best returns, leading to higher profits.

2. Helps with Business Growth

By carefully managing resources, companies can fund new projects, expand operations, and pursue new opportunities to grow and stay competitive.

3. Risk Management

Effective financial planning allows businesses to diversify their investments, reducing the risks of losing money by spreading funds across different areas.

Achieve Financial Success

Good financial planning is important for any company aiming for long-term growth. By strategically allocating funds, businesses can make sure that they are investing in the right areas for sustainable success and financial stability.

More Definitions: Risk Management in Marketing Definition, Customer Data Platform (CDP) Definition, Campaign Budgeting Definition, BANT Definition, Silver Bullet, Incremental Revenue, Cross Channel Marketing and Conversion Rate Optimization (CRO)

Useful Posts: 10 Ways to Raise Your Credibility on Your Website, Build a Unified Bank Sales & Marketing Engine and Understanding the 4 Keyword Types in SEO