Table of Contents

Why Total Addressable Market (TAM) is Non-Negotiable for Growth-Focused Leaders

Understanding Total Addressable Market (TAM): The Definitive Foundation

The Practical Guide: How to Calculate TAM Accurately

Beyond TAM: Total Addressable Market vs. SAM vs. SOM

Translating TAM Insights into Powerful Sales and Marketing Strategies

Market Sizing for Startups and Evolving Businesses: TAM’s Unique Role

Common Pitfalls and Best Practices in TAM Analysis

Useful Related Posts from Sales Funnel Professor

As a revenue leader, you’re likely wrestling with a common challenge: a nagging uncertainty about the true size and potential of your market. You see growth opportunities, yet resource allocation feels like a gamble. Sales efforts might feel diffused, and marketing spend perhaps less impactful than it should be. This fuzziness around your market isn’t just an abstract problem; it translates directly into inefficient operations, misalignment between sales and marketing teams, and ultimately, a slower, less predictable growth trajectory.

Many leaders confuse general market size with something far more precise and actionable: your Total Addressable Market, or TAM. Understanding and accurately defining your TAM isn’t a theoretical exercise for analysts; it’s the fundamental bedrock for informed strategic sales and marketing planning. It’s the metric that empowers you to prioritize effectively, justify investments with data, and set ambitious, yet realistic, goals for your teams. Getting this right is non-negotiable if you aim for efficient, sustainable, and scalable growth.

In this guide, we’ll cut through the ambiguity surrounding TAM. We’ll provide a practical, analytical framework for defining and calculating your TAM, distinguish it from related concepts like SAM and SOM, and, most importantly, show you exactly how to translate this critical market insight into powerful, data-driven strategies that drive revenue.

Why Total Addressable Market (TAM) is Non-Negotiable for Growth-Focused Leaders

The struggle is real for many heads of sales and marketing. You know your product or service solves a genuine problem, but pinpointing precisely who needs it and how many of them exist at scale can feel elusive. This lack of clarity on your true market potential is more than just an annoyance; it’s a significant impediment to efficient operations.

When your understanding of the market is fuzzy, resource allocation becomes guesswork. Are you deploying sales reps in the right territories? Is your marketing budget reaching the prospects most likely to convert? This is why calculating TAM is considered the foundational step in strategic planning, helping businesses allocate resources effectively and ground their sales forecasts in quantifiable data. Without a clear view of the Total Addressable Market, you risk scattering your efforts too broadly or focusing too narrowly on a segment that doesn’t represent the full opportunity. This leads directly to inefficient resource deployment and creates friction between sales and marketing teams who may be working off differing assumptions about where growth will come from.

Think of TAM as the foundational metric for all informed strategic planning in revenue generation. It provides the context for everything from setting sales quotas and designing commission plans to segmenting your audience for targeted marketing campaigns and forecasting future revenue. It’s the data point that allows you to move beyond intuition and anecdotal evidence to make decisions grounded in market reality.

Moreover, an accurate understanding of your TAM directly links to driving efficient, sustainable growth. It helps you understand the ultimate ceiling for your market penetration and revenue potential, allowing you to calibrate your growth ambitions. Knowing your TAM empowers you to justify significant investments in sales technology, marketing automation, or expansion into new territories because you can demonstrate the scale of the opportunity you’re aiming for. It enables you to set ambitious, yet realistically attainable, goals for your teams, fostering motivation and accountability. For any leader serious about building a predictable revenue engine, grasping and leveraging TAM is not optional – it’s essential.

Understanding Total Addressable Market (TAM): The Definitive Foundation

Let’s start by establishing a precise definition of TAM. Simply put, the Total Addressable Market represents the total market demand for a product or service. Imagine a world where every single potential customer who could benefit from and afford your offering used it. TAM is the maximum revenue you could possibly generate if you captured 100% of that demand. It is the theoretical upper limit of your revenue potential, assuming no competition and infinite capacity.

It’s crucial to distinguish TAM from broader “market size” figures often cited in industry reports. Market size might include adjacent opportunities or segments that are not relevant to your specific offering or business model. TAM, conversely, is defined specifically in relation to your product or service and, critically, your Ideal Customer Profile (ICP).

Defining your Ideal Customer Profile before attempting to calculate TAM is a non-negotiable first step. Your ICP is a detailed description of the type of company (or individual, in B2C) that would gain the most value from your solution and represents the most profitable customer for you. It goes beyond simple demographics to include firmographics (industry, size, location, revenue) and psychographics (challenges, goals, values). Without a clear ICP, your TAM calculation will be based on shaky ground, potentially including segments that are unlikely ever to become customers, inflating the number and leading to misguided strategies.

Reputable business sources and frameworks consistently define TAM as the ultimate market size. For instance, venture capital firms and financial analysts rely heavily on TAM figures to estimate the potential scale of a business. Consulting firms frequently employ TAM analysis as a foundational step in market entry or growth strategy engagements. The consensus across these authoritative sources underscores that TAM is not just a number; it’s a strategic perspective on the full scope of the opportunity available to a business focused on its ideal customer base.

The Practical Guide: How to Calculate TAM Accurately

Calculating your Total Addressable Market requires a structured approach and a willingness to make informed assumptions. It’s less about finding a single, universally “correct” number and more about developing a robust, data-backed estimate that provides a solid basis for strategic decisions. Before you dive in, you need to lay the groundwork by identifying necessary data points and resources. This could include internal data (CRM, sales records), third-party market research reports, government statistics, industry association data, and financial analyst projections.

It’s also vital to understand that any TAM calculation involves inherent assumptions. You’re estimating the potential demand across a vast, often not fully mapped, universe. These assumptions might relate to average selling price (ASP), potential usage rates, or the homogeneity of needs within your ICP. Documenting these assumptions is critical for transparency and for refining your estimates over time.

Key Methodologies for TAM Calculation

There are several recognized methodologies for calculating TAM, often used in combination to triangulate a more accurate figure:

Top-Down Approach

- Explanation: This method starts with broad, high-level market data and progressively narrows it down based on your specific market and ICP. You might begin with the total spending in an industry globally or regionally, then filter it down by the size of companies you target, their specific needs addressed by your solution, and perhaps geographic limitations.

- Pros: Often quicker and less resource-intensive initially. Provides a good starting point for understanding the overall market scale. Relies on readily available third-party data.

- Cons: Can be less precise as it relies heavily on the accuracy and relevance of external data sources, which may not perfectly align with your specific ICP. Can overestimate TAM if the filtering isn’t rigorous enough.

- Relevant data sources: Industry analyst reports (Gartner, Forrester, IDC), government economic data, market research databases, and financial reports of major industry players.

Bottom-Up Approach

- Explanation: This method starts with your most granular data point – your current customers and your well-defined ICP – and extrapolates potential market size. You might calculate the average revenue per customer within your ICP, then estimate the total number of companies (or individuals) matching that ICP profile in your target geographies. Multiplying the number of potential customers by the estimated average annual revenue per customer (or contract value) gives you a TAM figure.

- Pros: Generally more precise and grounded in real-world data derived from your actual sales and customer interactions. Provides a realistic view based on proven value delivery.

- Cons: Can be more resource-intensive as it requires detailed internal data and often necessitates external data to size the total number of ICPs. Requires a very well-defined ICP to be effective.

- Relevant data sources: Internal CRM data, sales intelligence platforms (e.g., ZoomInfo, Apollo.io), lead databases, pricing models, and customer segmentation analysis.

Value-Based Approach

- Explanation: This approach calculates TAM based on the quantifiable value your solution provides to the market. Instead of focusing solely on spending or the number of customers, you estimate the total economic benefit your solution delivers to the entire potential market. This benefit could be measured in cost savings, revenue uplift, or efficiency gains. If your solution saves companies $10,000 annually on average, and you estimate 10,000 potential ICP companies exist, the value-based TAM could be calculated based on capturing a portion of that $100 million in potential value.

- Applicability: Often relevant for innovative or disruptive solutions that create new markets or deliver value in ways not previously measured by traditional market spending. Requires a deep understanding of the economic impact of your solution.

A robust TAM calculation often combines methodologies. You might start with a top-down estimate for a broad market understanding, then refine it with a bottom-up approach based on your ICP and customer data. The value-based approach can provide an interesting third perspective, especially for novel solutions. The step-by-step process involves:

- Clearly define your ICP: Be as specific as possible.

- Choose your methodologies: Decide which combination of top-down, bottom-up, or value-based approaches is most appropriate.

- Identify and gather data: Collect relevant internal and external data.

- Apply the methodologies: Perform the calculations based on your chosen approaches and data.

- Document assumptions: Clearly list all assumptions made during the calculation.

- Compare and reconcile: If using multiple methods, compare the results and understand the reasons for any significant variances.

- Refine estimates: Address data gaps and uncertainties by making informed estimates, perhaps using ranges instead of single numbers. Iterate on the calculations as you gain more data or insights.

Dealing with data gaps is inevitable. You may need to rely on proxies or extrapolate from partial data. The key is transparency: clearly state where data is missing or estimated. Refining initial estimates through iterative analysis means revisiting your TAM calculation as you learn more about your market, validate assumptions, or adjust your ICP. TAM isn’t a one-time calculation; it’s a figure you should revisit periodically, perhaps annually or when strategic shifts occur.

Analysis: The two methods yield different figures ($1.2B vs $2.4B). CloudOptimize would then analyze the assumptions behind each number. The bottom-up figure ($1.2B) is likely more conservative and directly tied to their defined ICP and projected revenue model. The top-down figure ($2.4B) is much broader and relies on a high-level assumption about the addressable spend percentage. They might decide the $1.2B is a more grounded and actionable TAM for initial planning, while the $2.4B represents a theoretical maximum if their solution addressed a wider portion of the market or if their ICP assumptions were too conservative. They would document both figures and the assumptions supporting them. This example highlights how methodologies can yield different results and require careful analysis and reconciliation based on the confidence in underlying data and assumptions.

Simplified Illustrative Case Study: Calculating TAM for a B2B SaaS Company

Hypothetical Scenario: Let’s imagine “CloudOptimize,” a new SaaS product that uses AI to reduce cloud infrastructure costs for small and medium-sized businesses (SMBs). Their ICP is defined as companies in the US with 50-500 employees currently spending over $10,000/month on cloud services. CloudOptimize’s average annual contract value (AACV) is projected at $15,000 based on initial pilot customers and pricing models.

Bottom-Up Approach:

CloudOptimize uses a sales intelligence tool and market data to estimate the number of companies in the US matching their size criteria (50-500 employees) in relevant industries known for high cloud spend. Hypothetically, they find approximately 200,000 such companies.

Based on industry reports and their own analysis, they estimate that 40% of these companies likely spend over $10,000/month on cloud. (Assumption documented: 40% prevalence). This leaves 200,000 * 0.40 = 80,000 potential ICP companies.

TAM (Bottom-Up) = Number of potential ICP companies * AACV

TAM = 80,000 * $15,000 = $1.2 billion

Top-Down Approach:

CloudOptimize starts with the total estimated spend on cloud infrastructure services by SMBs in the US, drawing from analyst reports. Hypothetically, a report estimates this total spend at $80 billion.

They estimate that their specific AI optimization solution can address approximately 3% of this total spend (Assumption documented: 3% addressable spend).

TAM (Top-Down) = Total US SMB cloud spend * % addressable by solution

TAM = $80 billion * 0.03 = $2.4 billion

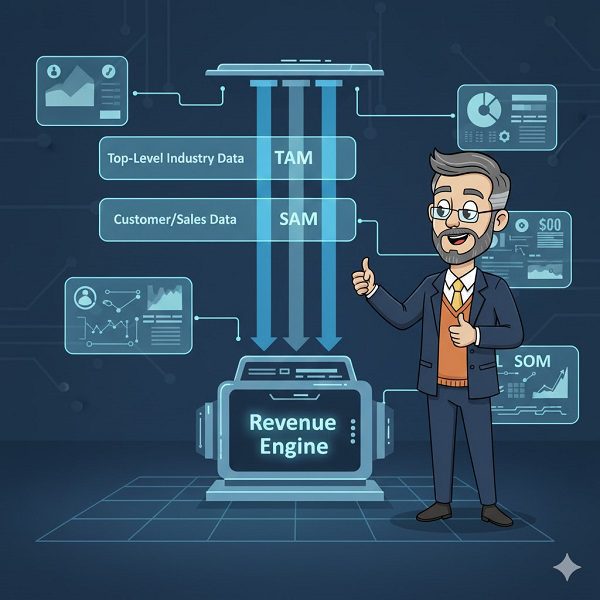

Beyond TAM: Total Addressable Market vs. SAM vs. SOM

While TAM provides the ultimate market ceiling, focusing solely on it can lead to unrealistic expectations and flawed strategies. For practical sales and marketing planning, you need to understand the hierarchy of addressable markets: TAM, SAM, and SOM.

- TAM (Total Addressable Market): As discussed, the total market demand, assuming a 100% market share, across your Ideal Customer Profile.

- SAM (Serviceable Available Market): This is the portion of the TAM that you can actually reach with your current product or service offering and business model. It accounts for limitations such as geographic reach, specific feature sets, or regulatory constraints. If your product is only available in North America, your SAM is the portion of your TAM that exists within North America. If your solution only supports specific operating systems, your SAM excludes ICPs using incompatible systems.

- SOM (Serviceable Obtainable Market or Share of Market): This is the realistic portion of the SAM that you can actually capture within a specific, defined timeframe (e.g., the next 1-3 years). This figure considers your current competitive landscape, your sales and marketing capacity, brand awareness, budget limitations, and market penetration goals. It’s the most practical number for near-term sales forecasting and marketing goal setting.

Visualizing the relationship is simple: TAM > SAM > SOM. Each layer is a subset of the one above it. Understanding this distinction is critical because each number serves a different purpose:

- TAM: Strategic vision, long-term potential, justifying overall market opportunity.

- SAM: Go-to-market strategy, product-market fit validation, assessing market reach with current offerings.

- SOM: Near-term operational planning, sales forecasting, marketing campaign goals, and resource allocation within a specific timeframe.

Solely focusing on TAM can lead to overambitious forecasts, misallocation of resources towards segments you can’t currently serve, and disappointment when actual results fall far short of theoretical potential. Conversely, only looking at SOM might limit your strategic vision and prevent you from investing in expanding your SAM (e.g., developing new features, entering new geographies) to capture a larger piece of the TAM over time. Understanding all three provides a comprehensive, layered view of market opportunity, which is essential to business strategy and growth planning.

Translating TAM Insights into Powerful Sales and Marketing Strategies

Possessing TAM, SAM, and SOM figures is valuable data, but the real impact comes from translating these insights into concrete, actionable sales and marketing strategies. This is where analysis moves from market sizing to strategic advantage.

Leveraging your TAM and SAM analysis allows you to refine your Ideal Customer Profile based on the nuances revealed. You might discover specific sub-segments within your initial ICP that represent a disproportionately large portion of your SAM, warranting greater focus. This leads directly to implementing effective market segmentation that is truly aligned with your addressable opportunities, ensuring your efforts are concentrated where they have the highest potential return.

For sales leaders, TAM and SAM insights are invaluable for informing sales territory planning and resource allocation. Instead of dividing regions based on outdated assumptions or simple geographic lines, you can align territories and assign quotas based on the estimated TAM/SAM within each area. This ensures sales capacity is matched to market potential.

For marketing leaders, this data guides everything from campaign targeting and messaging to channel selection. Knowing the size and characteristics of your SAM allows you to tailor messaging that resonates specifically with those reachable segments. It informs where to invest marketing budget – which channels, events, or content types are most likely to reach your addressable audience efficiently.

Perhaps most critically, TAM analysis is essential for setting accurate and motivating sales quotas and marketing performance indicators (KPIs). SOM provides the most realistic basis for near-term goals, ensuring that targets are challenging but achievable given your current capacity and market reach. This fosters accountability and prevents burnout or demotivation that can arise from targets based on unrealistic TAM assumptions.

Ultimately, leveraging TAM insights helps align sales and marketing efforts by providing a unified, data-driven view of market opportunity. Both teams can work from the same foundational numbers regarding the size and composition of the addressable market, reducing friction and enabling more cohesive go-to-market execution.

Integrating TAM Analysis into Revenue Operations (RevOps)

For organizations embracing Revenue Operations, integrating TAM analysis is a natural fit. It establishes a data-driven approach to understanding the market foundation of your revenue engine. This involves establishing data governance and tracking mechanisms within your CRM and marketing automation systems that align with your TAM/SAM/SOM definitions.

Ensuring your CRM and marketing automation systems support TAM-based segmentation and reporting allows you to track progress not just against arbitrary numbers, but against the defined potential of your addressable market. This enables more sophisticated analysis, such as market penetration rates within specific segments.

Furthermore, using TAM and SAM insights can optimize lead scoring and routing. Leads originating from segments identified as high-potential within your SAM can be prioritized and routed to the appropriate sales resources more efficiently, accelerating the sales cycle and improving conversion rates. By embedding market sizing data into your RevOps framework, you create a feedback loop where market insights continually inform and optimize operational execution across sales, marketing, and customer success.on building relationships, addressing specific needs, and converting qualified opportunities into revenue.

Market Sizing for Startups and Evolving Businesses: TAM’s Unique Role

Market sizing, particularly TAM analysis, plays a unique and often critical role for startups and businesses undergoing significant evolution (e.g., launching a new product line, entering a new market).

For startups, defining and calculating market potential presents specific challenges. Data may be scarce, the ICP might be evolving, and the market itself might be new or undefined. However, a robust TAM analysis is absolutely crucial for fundraising. Investors want to see that your potential market is large enough to support significant growth and deliver substantial returns. A well-researched TAM calculation validates the business viability and the potential scale of the opportunity. It demonstrates that you’ve thought rigorously about who your customer is and how big the need is.

As you achieve product-market fit, learn more about your early customers, and refine your offering, your understanding of your ICP and thus your TAM will evolve. The initial TAM calculation is a starting point, not a final destination.

Applying TAM, SAM, and SOM concepts is particularly relevant for startups running pilot programs or executing initial market entry strategies. Your SOM for a pilot is likely tiny compared to your SAM, but defining it helps set realistic expectations for early results. As you validate your model and scale, your SOM should grow towards your SAM.

Business models and target markets are rarely static, especially for growing companies. Adjusting and revisiting your TAM analysis is essential whenever there’s a significant shift – launching a major new feature that expands your addressable use cases, targeting a new industry, or entering a new geographic region. Your TAM calculation should be a living document that reflects your evolving business strategy.

Insights from recognized business analysts emphasize the importance of bottom-up validation for startups. While top-down figures provide context, demonstrating a repeatable sales motion and strong early traction with a clearly defined ICP (the essence of the bottom-up approach) is often more persuasive to investors and more useful for operational planning. Market sizing for startups is as much about proving obtainability (SOM) within a small initial market as it is about demonstrating ultimate potential (TAM).

Common Pitfalls and Best Practices in TAM Analysis

Even with the best intentions, it’s easy to stumble when defining and leveraging your TAM. Recognizing common pitfalls is the first step to avoiding them.

Frequent mistakes include:

- Overly Optimistic Projections: Allowing enthusiasm to inflate numbers, ignoring realistic limitations, or competition.

- Outdated or Irrelevant Data: Relying on old market reports or data that doesn’t precisely match your ICP or market segment.

- Insufficient Segmentation: Failing to break down the market granularly enough based on your ICP and product fit, leading to a single, unhelpful number.

- Confusing TAM, SAM, and SOM: Using the largest number (TAM) for short-term operational goals, leading to unattainable targets.

The danger of “guesstimating” vs. conducting rigorous analysis cannot be overstated. A quick, back-of-the-envelope estimate might feel sufficient, but it lacks the data foundation needed to build credible strategies or gain internal buy-in. Rigorous analysis, even with documented assumptions, provides a far more reliable compass.

Best practices for maintaining and updating TAM calculations over time include:

- Regular Review: Revisit your TAM, SAM, and SOM calculations regularly (e.g., annually) or whenever significant market shifts occur.

- Data Hygiene: Ensure the internal data used for bottom-up calculations (CRM data, customer records) is clean and accurate.

- Cross-Functional Collaboration: Your TAM calculation should not live in a silo. Involve Sales (for ground-level customer insights), Marketing (for audience understanding), Finance (for modeling and validation), and Product teams (for understanding feature relevance and potential use cases). This collaboration ensures the calculation is comprehensive and gains broader organizational buy-in.

- Using TAM as a Dynamic Tool: Don’t calculate TAM once and forget it. Use it as a living benchmark for measuring penetration, identifying growth opportunities, and refining strategy.

- Communicating TAM Insights Effectively: Clearly articulate your TAM, SAM, SOM, methodologies and assumptions to stakeholders across the organization. Ensure everyone is working from the same understanding of market potential.

By approaching TAM analysis as an ongoing, collaborative, and data-driven process, you transform it from a static report into a powerful, dynamic tool for driving intelligent sales and marketing decisions.

Defining and segmenting your Total Addressable Market is far from a mere academic exercise; it is fundamental to building efficient sales and marketing operations and achieving scalable growth. It provides the essential clarity needed to move past guesswork and make strategic decisions grounded in data. From refining your Ideal Customer Profile and segmenting your market with precision to aligning sales territories, targeting marketing campaigns effectively, and setting realistic goals, an accurate TAM understanding is the bedrock.

By distinguishing between TAM, SAM, and SOM, applying rigorous calculation methodologies, and integrating this analysis into your revenue operations, you equip your teams with the insights necessary to focus their efforts, optimize resource allocation, and drive predictable revenue growth. Don’t let a fuzzy view of the market hold you back. Embrace the data, define your TAM accurately, and unlock your full growth potential.

Ready to gain clarity on your market potential? Download our template for calculating your TAM.

The Total Addressable Market (TAM) is the ultimate measure of your ambition, but sustainable growth demands honesty. By integrating TAM, SAM, and SOM into your strategy, you transform your potential into a predictable, achievable revenue engine grounded in market reality. Use these additional resources to dive deeper into the tactics, definitions, and audits that ensure your entire revenue engine is running smoothly:

- Sales Funnel vs Marketing Funnel – A detailed guide distinguishing between the two funnels and providing strategies for essential sales and marketing alignment.

- Digital Roadmap Essentials – Your strategic blueprint for growth, breaking down the stages from goal setting to performance measurement.

- Essential Marketing Terms Leadership Must Know – A guide to key terminology to empower leaders for better strategy and data-driven decision-making.

- Sales Funnel Audit – A forensic, end-to-end diagnostic service that precisely identifies conversion bottlenecks and revenue leaks across your entire sales process.

- What is ICP? A Guide to Creating Your Ideal Customer Profile – Learn to define the foundational profile of the ideal company that guarantees maximum value, sales efficiency, and long-term retention.